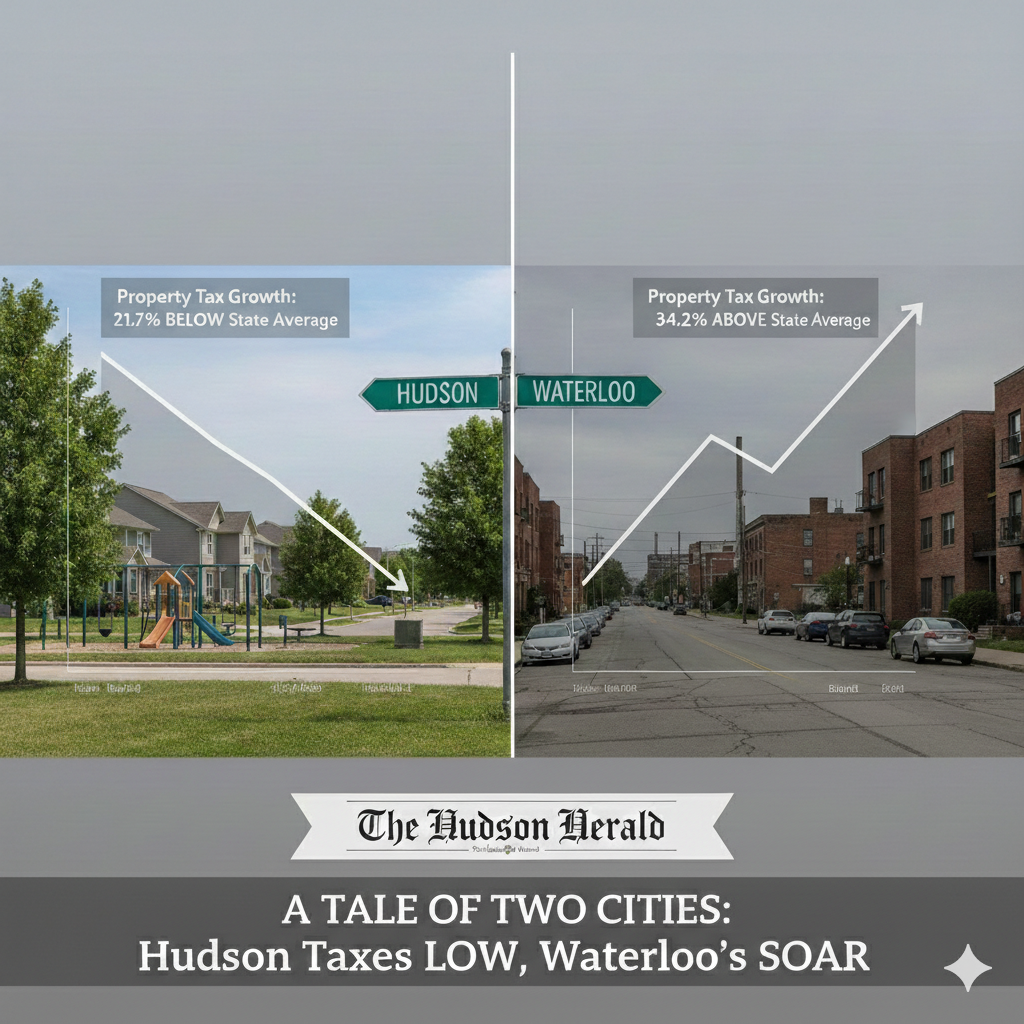

A Tale of Two Cities: Hudson Property Taxes Below State Average as Waterloo Ranks Among Iowa’s Highest

By Hudson Herald Staff

As Iowans look ahead to the next round of property tax assessments, new data from ITR Local, a public tax transparency tool operated by the ITR Foundation, a nonpartisan research organization that analyzes state and local taxation and spending, highlights a sharp contrast between the fiscal landscapes of Hudson and its northern neighbor, Waterloo.

While Hudson residents pay a total levy rate below the statewide average, Waterloo ranks among the most expensive cities in Iowa for property owners, according to the organization’s latest reporting.

Hudson: Managing Growth Responsibly

According to ITR Local’s analysis of city-specific spending and taxation, Hudson is operating with a total levy rate of $11.35 per $1,000 of taxable value, compared with the Iowa statewide average of $12.70. ITR Local defines “reasonable tax growth” as growth that remains close to the combined percentage change of population growth and inflation. By that standard, Hudson’s figures reflect measured growth: Population change: 23.0%

Inflation: 34.3%

Property tax growth: 21.7%

Because Hudson’s property tax growth is well below the combined population and inflation benchmark of 57.3%, ITR Local classifies the city’s tax growth as reasonable, noting that taxes are growing 35.6% slower than the benchmark.

Hudson also compares favorably with other cities in its population range (2,500–3,000 residents). Hudson’s levy rate of $11.35 is lower than nearby Jesup at $14.43 and Grundy Center at $16.24.

Waterloo: A Different Reality

Just a short drive away, Waterloo’s data presents a contrasting picture. The city’s total levy rate stands at $21.79 per $1,000, nearly double Hudson’s rate and well above the statewide average. In a recent report titled “Where Property Taxes Hit Hardest in Iowa,” the ITR Foundation identified Waterloo as having an effective consolidated property tax rate of 2.12%, ranking it among the highest in the state alongside Keokuk.

By comparison, several peer cities classified as “large cities” maintain significantly lower levy rates:

• Ames: $10.30

• Cedar Falls: $12.20

• Waterloo: $21.79

ITR Local categorizes Waterloo’s tax growth as unreasonable, reporting that the city’s property tax revenue increased 34.2% during a period when its population declined by 1.7%. As a result, Waterloo’s tax growth exceeded the “reasonable” benchmark by 1.6%.

Where Does the Money Go?

The two cities also differ in how they allocate spending, according to ITR’s breakdown. Hudson directs its largest share of spending to public safety (21%), followed by debt service (16%) and capital projects (13%).

Waterloo allocates 32% of its budget to capital projects, with public safety (16%) and public works (14%) comprising the next largest categories.

The Local Impact

For Hudson residents, the ITR Local data provides both context and a benchmark as future City Council budget discussions approach. While property tax growth statewide is often criticized for outpacing inflation, Hudson’s figures place it among communities maintaining more restrained growth.

“The information provided on ITR Local is intended to help start a conversation with the people who determine how much you pay,” the organization states. For residents in the Hudson Herald’s coverage area, that conversation may look different than the one unfolding in Waterloo this winter.

Data in this article is provided by ITR Local, a transparency tool by the ITR Foundation utilizing data from the U.S. Census Bureau and the Iowa Department of Management.

Comments ()